When you think of a checking account, you probably think of a bank account, debit cards, deposits, and withdrawals. But what about earning money?

With REV, you can! REV’s Premier Checking account lets your money do the work for you. All you have to do is open a Premier Checking account, and you’ll start earning dividends on your balance right away – it’s that easy!

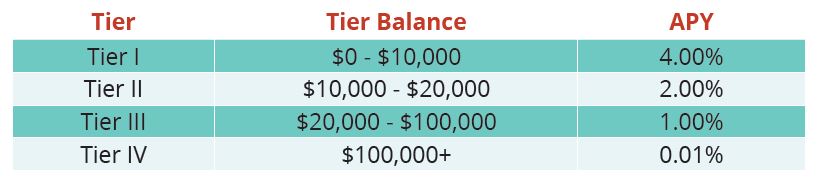

When you open a Premier Checking account, your balance earns up to 4% APY (Annual Percentage Yield). At REV, you’re always earning on your balance, helping you reach your financial goals faster. Our accounts are designed to give you what you need with none of the hassle.

How Does a REV Premier Checking

Account Work?

Simply put, our Premier Checking account is the best of both worlds: easy access to your money and you earn dividends on your account balance.

Since REV is a credit union, the money you earn on your account balance is called dividends. With a Premier Checking account, you can earn up to 4% APY on your balance, and the percentage you earn depends on the balance in your account.

Benefits of a REV Premier Checking Account

With our Premier Checking account, you earn money just by banking with REV. Along with dividends, you have the potential to earn cash back when you use your REV debit card.

Some other perks of opening a Premier Checking account with REV include:

How Do I Know if a REV Premier Checking Account is Right For Me?

Opening a Premier Checking account is great for anyone who wants to earn money on their deposits.

You may want to consider our Premier Checking account if you currently have money in a Certificate of Deposit (CD) that is maturing soon.

By transferring those funds to a REV Premier Checking account after your CD matures, you can continue to earn on your saved money. Plus, since the funds are now in your checking account, you have the option to use the funds if you need them while still earning up to 4% APY on the balance.

At many banks and credit unions, checking accounts may not earn interest or dividends, and many come with fees or account minimums. If you want more from your checking account, you need checking powered by REV.