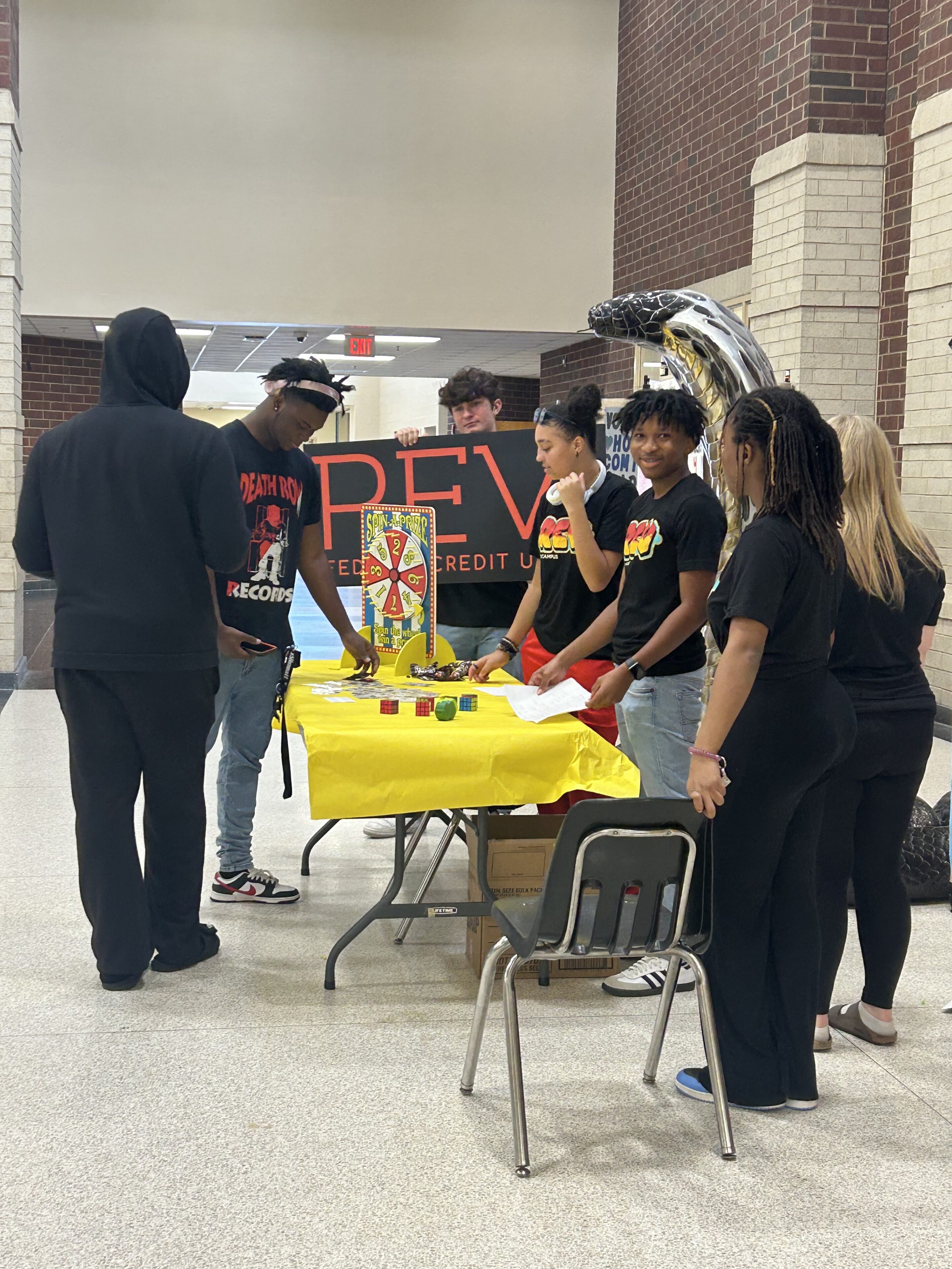

REV on Campus is a hands-on, career-building program that partners with local high schools to prepare students for real-world roles in financial services and marketing.

Recognized by the South Carolina Department of Education as a top career and technical education (CTE) program, and awarded The Desjardins Youth Financial Education Award for its leadership in youth financial education, REV on Campus offers four unique paths—finance and account management, brand marketing, public relations, and leadership—each providing hands-on experience and knowledge of the credit union industry. Through classroom learning and paid, on-the-job experience, students—called Brand Influencers—gain practical skills, industry exposure, and a head start on their professional futures.

Students also receive additional curriculum in their chosen area to spark further exploration and career growth. Many even continue their experience beyond the classroom, working in REV locations during summer and holiday breaks while getting paid. Beyond the branch, students gain exposure to the broader world of banking through job shadowing, career workshops, and events like REV Day and REV Day for Good. REV on Campus is all about preparing students for future careers while having fun and making an impact!

A Legacy of Learning

Program Launch

The program launched in 2015, with Cane Bay High School joining in 2016, marking early expansion into local schools.

Serving Two Districts

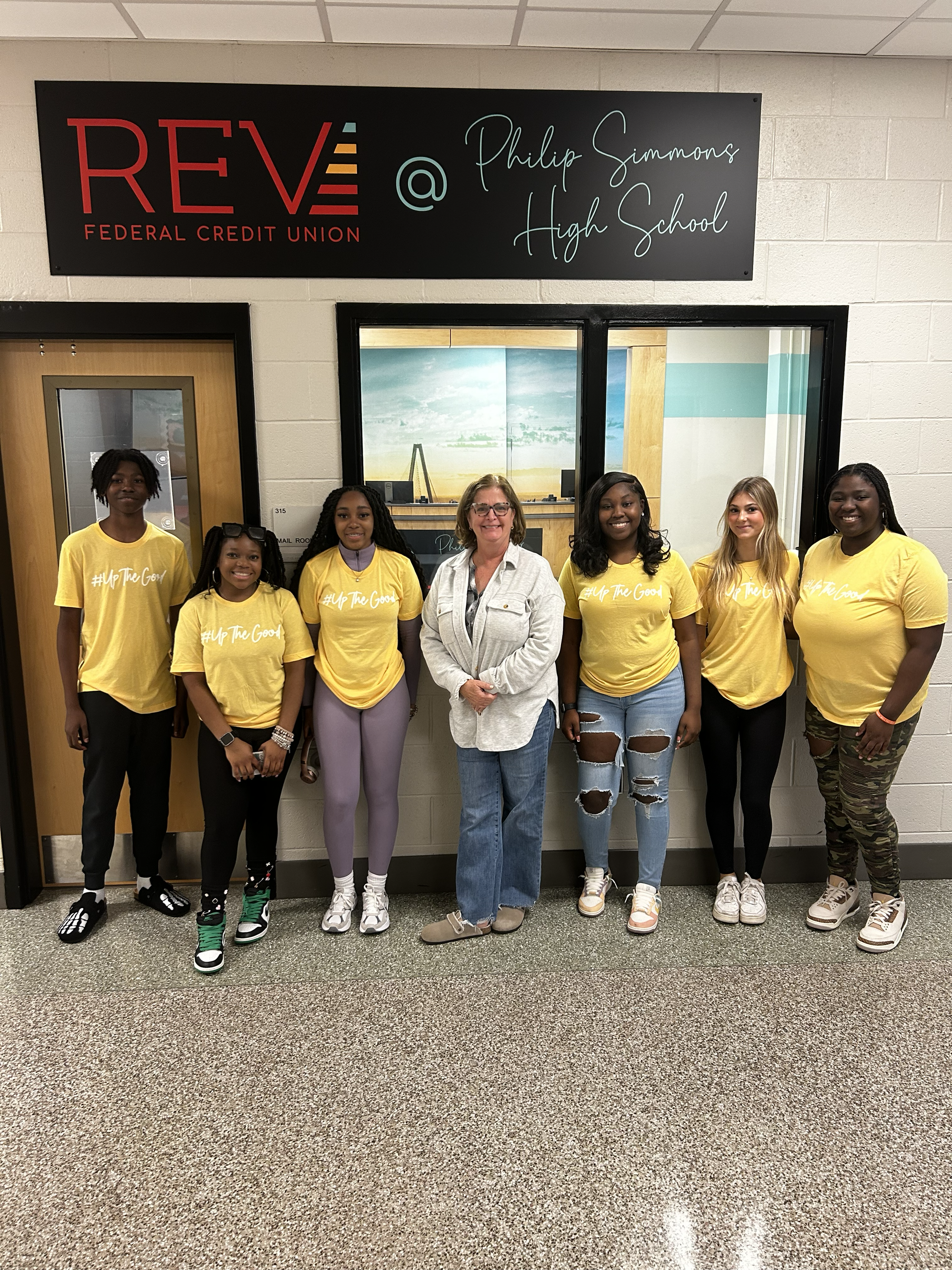

Today, the program serves students across two school districts: Charleston County and Berkeley County.

Charleston County School

R.B. Stall High School participates as the program’s Charleston County location.

Berkeley County Schools

Cane Bay High School and Philip Simmons High School represent Berkeley County

Enrollment

For the 2025–2026 school year, 24 students are enrolled and supported by three dedicated Teacher Advisors.

Program Rebrand

In 2022, the program was rebranded as REV on Campus as it transitioned from a retail focus to a marketing-based experience.

Statewide Recognition

Recognized by the South Carolina Department of Education as a top CTE program and recipient of the Desjardins Youth Financial Education Award.

Participation

Approximately 87 students participated from 2022–2025; earlier data is unavailable due to coding changes.

What is a Brand Influencer?

Brand Influencers are trained student interns who represent REV. They gain hands-on experience with how a financial institution operates while building transferable skills such as communication, teamwork, professionalism, and financial literacy.

What Influencers Do:

Training & Support

Participating Schools

Cane Bay

High School

Philip Simmons

High School

R.B. Stall

High School

Skills for Today, Success for Tomorrow!

REV offers workshops designed to help high school students and recent grads kickstart their financial journey. Our sessions provide practical advice and tools to help teens make smart money decisions. From mastering budgeting and understanding credit to learning how to invest, our engaging topics give students the confidence to take control of their finances. Plus, you can mix and match topics to create a custom event tailored to your class’s needs.

Reality of Money:

The financial simulation that puts Teens in the driver’s seat.

Reality of Money gives high school students a real-life crash course in managing their finances. In this interactive simulation, teens step into the world of wage earners and bill payers, making decisions that affect their budgets and lifestyle. With hands-on stations, they’ll learn how everyday choices—like budgeting, paying bills, and saving—can shape their future and build the skills needed to handle money with confidence.

What you need to know.

Takes about 2 hours to complete

Perfect for teens ages 13-18

Great for class sizes of 50 to 300 students

A classroom version is available for smaller groups

Fun for youth groups and camps

The Reality of Money, Unscripted

Real talk, from real people.