Built for Community. Certified to Serve.

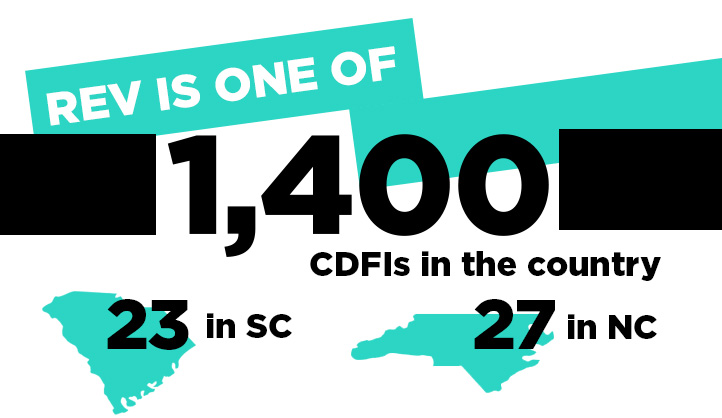

At REV, community isn’t a buzzword, it’s the heart of our purpose. One of the most meaningful ways we live that purpose is through our designation as a Community Development Financial Institution (CDFI). This certification sets us apart from traditional financial institutions and shows, in a very real way, how we put people and places over profits.

What Does It Mean to Be a CDFI?

A Community Development Financial Institution (CDFI) is a mission-driven financial institution certified by the U.S. Department of the Treasury. CDFIs exist to expand economic opportunity in low-income and underserved communities, especially where access to traditional financing is limited.

For REV, this certification isn’t symbolic. It’s a commitment backed by accountability, measurable impact, and meaningful investment.

What makes CDFIs different?

Community-first

mission:

Promoting community development is our primary purpose.

Federal

certification:

We are certified by the U.S. Department of the Treasury’s CDFI Fund.

Focused

impact:

At least 60% of our activity is directed toward low-income individuals or communities.

More than

banking:

In addition to financial products, we support financial education, coaching, and long-term stability.

Community

accountability:

We maintain strong ties to the communities we serve, ensuring our decisions reflect real local needs.

Low-Income Designated. High-Impact Focused.

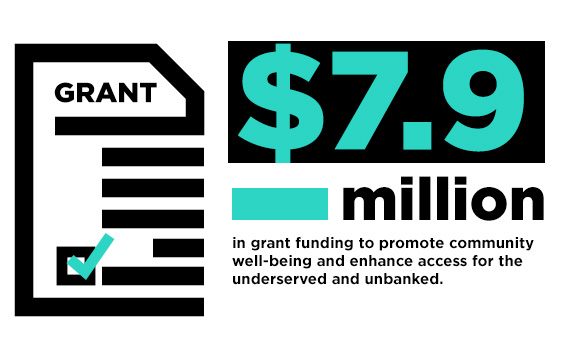

REV is proud to be a Low-Income Designated CDFI, which means we intentionally serve communities that are often overlooked by mainstream financial institutions. This designation allows us to access specialized federal programs and grants that offer resources we reinvest directly back into our communities.

The result? More affordable lending, stronger local businesses, expanded access to credit, and long-term economic resilience.

How These Programs Make a Difference

Financial Assistance (FA) Grants

Rapid Response Program (RRP)

Equitable Recovery Program (ERP)

Emergency Capital Investment Program (ECIP)

Why This Matters And Why It Sets REV Apart

Many financial institutions talk about community. Few are federally certified, measured, and funded to serve it. Being a CDFI means:

At REV, your membership helps fuel this work. Every loan, every deposit, every relationship strengthens our ability to invest back into the community we all share.

Community Is Not a Side Project. It’s the Point.

CDFI certification allows REV to do what we’ve always believed in; meeting people where they are, expanding access to opportunity, and building stronger communities together. This is what sets REV apart. And it’s how we continue to put purpose into practice, every day.